Why we opt for Incineration Technology ?

The Reality

Nowadays, the global market presents numerous technologies for recovering energy from waste, so why do we opt for incineration? Alternative technologies such as pyrolysis, gasification, or plasma treatment are also widely recognized.

In our everyday activities, we face various prevalent misconceptions regarding incineration. These misconceptions result in a complete misunderstanding of the prominence and functions of contemporary waste-to-energy technologies. That is the reason we believe it is necessary to provide commentary on the existing technology.

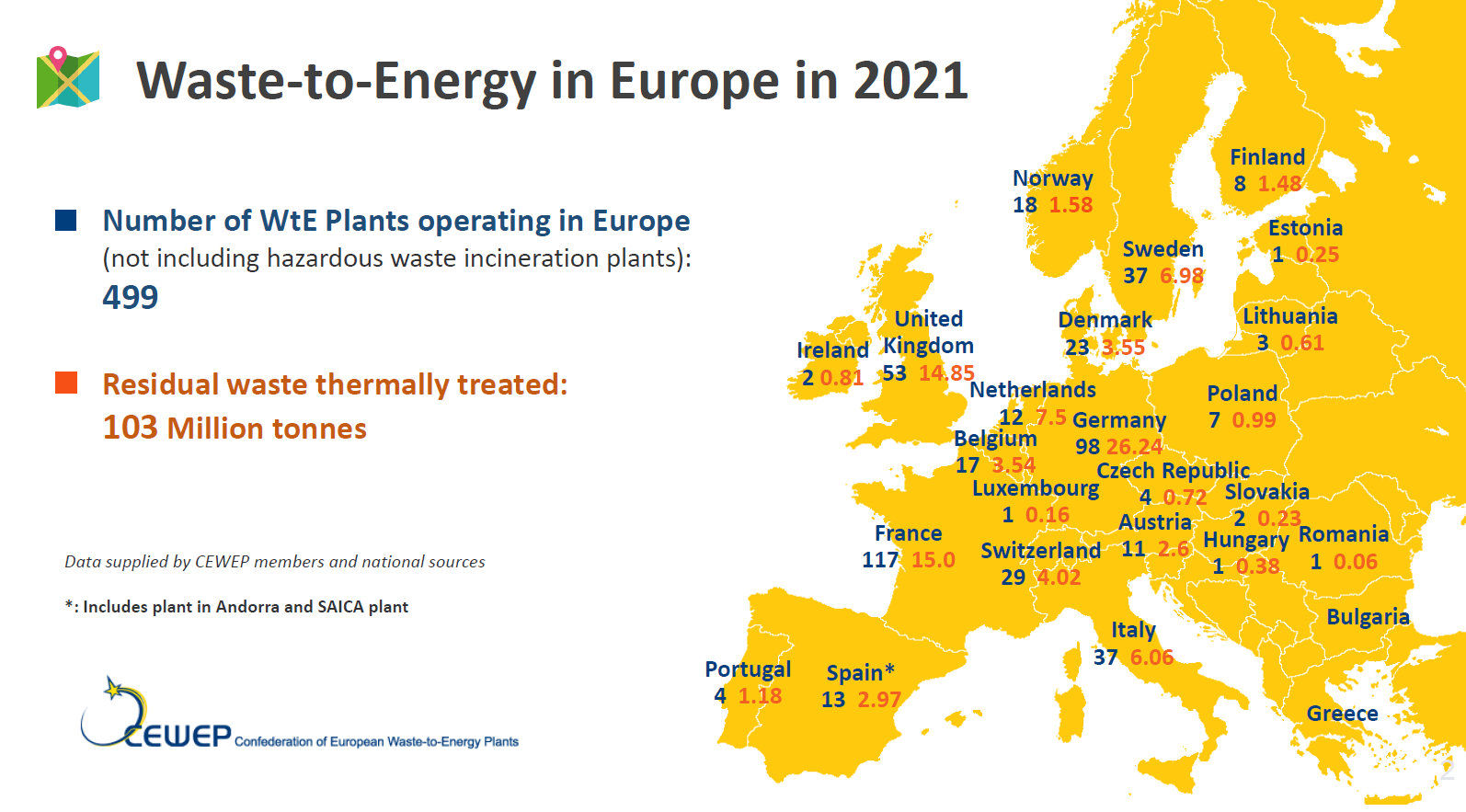

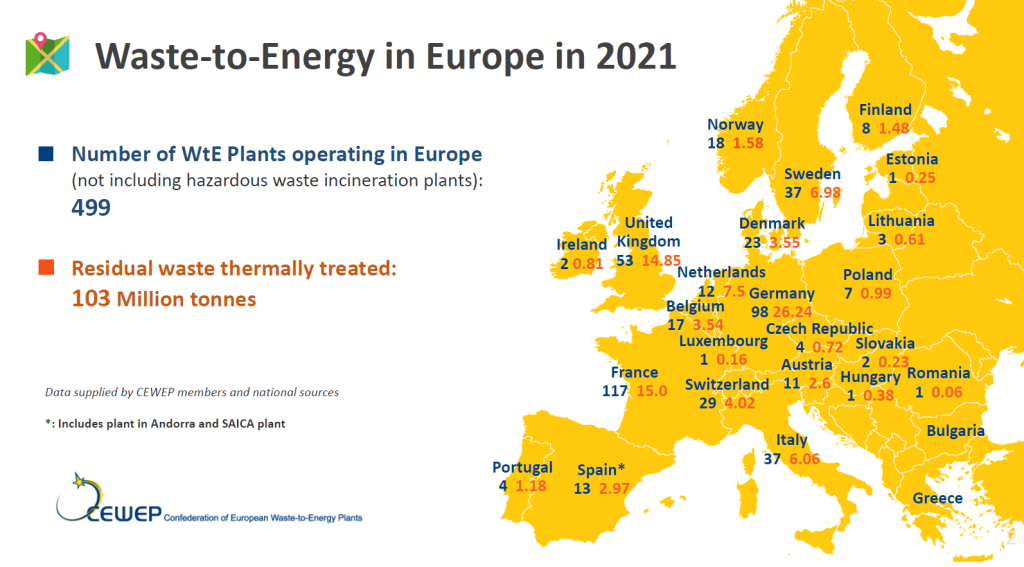

The map below illustrates the number of waste-to-energy plants in Europe alone (blue numbers) along with the amount of waste in million tons being incinerated annually (red numbers).

Waste to Energy Plants in Europe

Each year, CEWEP publishes a map of Waste-to-Energy plants in Europe, based on data coming from CEWEP members and national sources.

This overview shows that Waste-to-Energy treatment capacity was overall stable compared to 2020, with a small increase in capacity.

THe overall number of facilities slightly decreased compared to 2020 due to a change in our data collection methodology.

CEWEP EU Map for WTE 2021

The Hard Truth

Even if we do not provide incineration plants to our clients, we must reference incineration as a benchmark. Because it is a globally dominant, well-recognized technology. Incineration is not being dismissed, as some commentators have indicated, but rather the opposite. An extract from the extensive 1000-page plus report “Waste to Energy 2024/2025” by Ecoprog, a reputable consultant known for thorough market analysis, can be downloaded. ecoprog extract link 2024/2025

Ecoprog states: “As of early 2024, there were more than 2,800 WtE plants worldwide, reaching a disposal capacity of about 576 million tons per year. We estimate about 3,100 plants with a capacity of more than 700 million tons to be operational by 2033. This is 600 more increase as predicted from the 2,200 WtE facilities operational around the globe 10 years ago. ” As indicated on page 4 of the extract, ECOPROG only accounts for “9. 2 Thermal treatment: incineration and gasification” technologies. This is due to the fact that other technologies such as pyrolysis and plasma treatment hold a minimal market share.

It is challenging to pitch incineration plants to clients because frequently, public perception is influenced by speculation and misinformation about the market. Nonetheless, what is clear is that we need to evaluate any technology against incineration, as it remains the most validated and widespread technology globally. We cannot draw comparisons between our offerings and questionable pyrolysis manufacturers, whose systems lack a proven history of success.

Thus, when we present any other alternative waste to energy technology mainly aimed at MSW, we consistently compare CAPEX, OPEX, capacity factor, and energy generation with incineration plants of comparable capacity. This approach provides our client with a solid foundation for comprehending the project and technology.

And indeed, incineration continues to evolve and has not yet made its final mark in the global waste-to-energy sector.

The Industry Barometer

2024 was a favourable year for Waste-to-Energy (WtE), according to the yearly Waste-to-Energy Industry Barometer.

The report shows an increase in optimism among WtE plant operators, with the business climate index climbing to 91. 7 points in 2024 from 87. 6 in 2023; this is amidst a challenging economic landscape.

The Barometer also points to an enhancement in plant utilization, with 66% of participants indicating high usage compared to 42% last year.

The results show increasing optimism among WtE plant operators. Gate fees are expected to rise, especially in Germany, where the implementation of a CO₂ levy in January 2024 has heightened expenses for WtE facilities. At the same time, 95% of plant operators assessed their current business situation as “good” or “satisfactory,” underscoring the sector’s durability under escalating pressures.

The report also highlights considerable obstacles to progressing carbon management technologies, including high investment expenses, insufficient regulatory frameworks, and infrastructure issues such as the absence of CO₂ transport pipelines.

While 61% of operators are in discussions about carbon capture initiatives, only 14% have made significant moves towards implementation.

Numerous industry stakeholders consider carbon management crucial for meeting the EU’s net-zero emissions objectives, yet advancement is slow. Operators emphasize the critical need for financial incentives and legal clarity to promote carbon capture and help achieve the EU’s net-zero ambitions.

Globally, Europe continues to be the largest market for WtE technologies, but the emphasis has shifted towards maintaining and modernizing aging infrastructure instead of new developments.

Beyond Europe, market growth is sluggish in areas such as India and Brazil, where insufficient financial incentives, regulatory hurdles, and public perception challenges impede development. In China, a significant drop in WtE projects, influenced by the real estate crisis, has diminished its global impact, although it remains the leading WtE market by capacity.

The Industry Barometer stresses the significance of favorable policies and investments to maintain the sector’s growth. The findings support a comprehensive strategy for waste management, acknowledging the contribution of WtE in meeting environmental objectives while tackling economic and technical challenges.

Reference – https://www.cewep.eu/wp-content/uploads/2024/10/Industry-Barometer-Waste-to-Energy-2024.pdf

Read MoreCan green hydrogen save a coal town and slow climate change?

A smokestack stands at a coal plant on Wednesday, June 22, 2022, in Delta, Utah. Developers in rural Utah who want to create big underground caverns to store hydrogen fuel won a $504 million loan guarantee this spring. They plan to convert the site of the plant completely to cleanly-made hydrogen by 2045. (AP Photo/Rick Bowmer)

DELTA, Utah (AP) – The coal plant is closing. In this tiny Utah town surrounded by cattle, alfalfa fields and scrub-lined desert highways, hundreds of workers over the next few years will be laid off – casualties of environmental regulations and competition from cheaper energy sources.

Yet across the street from the coal piles and furnace, beneath dusty fields, another transformation is underway that could play a pivotal role in providing clean energy and replace some of those jobs.

Here in the rural Utah desert, developers plan to create caverns in ancient salt dome formations underground where they hope to store hydrogen fuel at an unprecedented scale. The undertaking is one of several projects that could help determine how big a role hydrogen will play globally in providing reliable, around-the-clock, carbon-free energy in the future.

What sets the project apart from other renewable energy ventures is it’s about seasonal storage more than it’s about producing energy. The salt caves will function like gigantic underground batteries, where energy in the form of hydrogen gas can be stored for when it’s needed.

“The world is watching this project,” said Rob Webster, a co-founder of Magnum Development, one of the companies spearheading the effort. “These technologies haven’t been scaled up to the degree that they will be for this.”

In June, the U.S. Department of Energy announced a $504 million loan guarantee to help finance the “Advanced Clean Energy Storage” project – one of its first loans since President Joe Biden revived the Obama-era program known for making loans to Tesla and Solyndra. The support is intended to help convert the site of a 40-year-old coal plant to a facility that burns cleanly-made hydrogen by 2045.

Amid polarizing energy policy debates, the proposal is unique for winning support from a broad coalition that includes the Biden administration, Sen. Mitt Romney and the five other Republicans who make up Utah’s congressional delegation, rural county commissioners and power providers. Biden was set to announce new actions on climate change Wednesday during an event in Massachusetts at a former coal-fired power plant that is shifting to a renewable energy hub.

Renewable energy advocates see the Utah project as a potential way to ensure reliability as more of the electrical grid becomes powered by intermittent renewable energy in the years ahead.

In 2025, the initial fuel for the plant will be a mix of hydrogen and natural gas. It will thereafter transition to running entirely on hydrogen by 2045. Skeptics worry that could be a ploy to prolong the use of fossil fuels for two decades. Others say they support investing in clean, carbon-free hydrogen projects, but worry doing so may actually create demand for “blue” or “gray” hydrogen. Those are names given to hydrogen produced using natural gas.

“Convincing everyone to fill these same pipes and plants with hydrogen instead (of fossil fuels) is a brilliant move for the gas industry,” said Justin Mikula, a fellow focused on energy transition at New Consensus, a think tank.

Unlike carbon capture or gray hydrogen, the project will transition to ultimately not requiring fossil fuels. Chevron in June reversed its plans to invest in the project. Creighton Welch, a company spokesman, said in a statement that it didn’t reach the standards by which the oil and gas giant evaluates its investments in “lower carbon businesses.”

As utilities transition and increasingly rely on intermittent wind and solar, grid operators are confronting new problems, producing excess power in winter and spring and less than needed in summer. The supply-demand imbalance has given rise to fears about potential blackouts and sparked trepidation about weaning further off fossil fuel sources.

This project converts excess wind and solar power to a form that can be stored. Proponents of clean hydrogen hope they can bank energy during seasons when supply outpaces demand and use it when it’s needed in later seasons.

Here’s how it will work: solar and wind will power electrolyzers that split water molecules to create hydrogen. Energy experts call it “green hydrogen” because producing it emits no carbon. Initially, the plant will run on 30% hydrogen and 70% natural gas. It plans to transition to 100% hydrogen by 2045.

When consumers require more power than they can get from renewables, the hydrogen will be piped across the street to the site of the Intermountain Power Plant and burned to power turbines, similar to how coal is used today. That, in theory, makes it a reliable complement to renewables.

Many in rural Delta hope turning the town into a hydrogen epicenter will allow it to avoid the decline afflicting many towns near shuttered coal plants, including the Navajo Generating Station in Arizona.

But some worry using energy to convert energy – rather than sending it directly to consumers – is costlier than using renewables themselves or fossil fuels like coal.

Though Michael Ducker, Mitsubishi Power’s head of hydrogen infrastructure, acknowledges green hydrogen is costlier than wind, solar, coal or natural gas, he said hydrogen’s price tag shouldn’t be compared to other fuels, but instead to storage technologies like lithium-ion batteries.

For Intermountain Power Agency, the hydrogen plans are the culmination of years of discussions over how to adapt to efforts from the coal plant’s top client – liberal Los Angeles and its department of water and power – to transition away from fossil fuels. Now, resentment toward California is sweeping the Utah community as workers worry about the local impacts of the nation’s energy transition and what it means for their friends, families and careers.

“California can at times be a hiss and a byword around here,” city councilman Nicholas Killpack, one of Delta’s few Democrats, said. “What we I think all recognize is we have to do what the customer wants. Everyone, irrespective of their political opinion, recognizes California doesn’t want coal. Whether we want to sell it to them or not, they’re not going to buy it.”

The coal plant was built in the wake of the 1970s energy crisis primarily to provide energy to growing southern California cities, which purchase most of the coal power to this day. But battles over carbon emissions and the future of coal have pit the states against each other and prompted lawsuits. Laws in California to transition away from fossil fuels have sunk demand for coal and threatened to leave the plant without customers.

In Millard County, a Republican-leaning region where 38% of local property taxes come from the Intermountain Power Plant, two coal plant workers unseated incumbent county commissioners in last month’s Republican primary. The races saw campaign signs plastered throughout town and tapped into angst about the multimillion-dollar plans and how they may transform the job market and rural community’s character.

“People are fine with the concept and the idea of it being built,” Trevor Johnson, one of the GOP primary winners, said, looking from the coal plant’s parking lot toward where the hydrogen facility will be. “It’s just coal power is cheap and provides lots of good jobs. That’s where the hang-up is.”

Read MoreGreen hydrogen project receives $504 million DOE loan guarantee

A green hydrogen project in Utah has received a $504.4 million loan guarantee from the Department of Energy’s Loan Programs Office, the first guarantee awarded to a clean energy project in nearly a decade.

The Advanced Clean Energy Storage project will combine 220 MW of alkaline electrolysis with two 4.5-million-barrel salt caverns to store clean hydrogen.

The project is intended to capture excess renewable energy when it is most abundant, store it as hydrogen, and then deploy it as fuel for the Intermountain Power Agency’s IPP Renewed Project. The hydrogen-capable gas turbine combined cycle power plant would be incrementally fueled by 100% clean hydrogen by 2045.

The Advanced Clean Energy Storage project received a conditional commitment from LPO in April. This is the first time a green hydrogen project has received a loan guarantee from DOE.

The Utah project is planned to include retiring existing coal-fueled power generating units at the IPP site; installing new natural gas-fueled electricity generating units capable of utilizing hydrogen for 840 MW net generation output; modernizing IPP’s Southern Transmission System linking IPP to Southern California, and developing hydrogen production and long-term storage capabilities.

IPP would use renewable energy-powered electrolysis to split water into oxygen and hydrogen. The new natural gas generating units, expected to be supplied by Mitsubishi Power, would use 30% hydrogen fuel at start-up, transitioning to all hydrogen fuel by 2045 as technology improves. The Los Angeles Department of Water and Power would be the off-taker for electricity produced by the facility.

50-fold increase

Across all its programs, LPO has attracted more than 70 active applications for projects in 24 states totalling nearly $79 billion in requested loans and loan guarantees as of the end of May.

With the closing of this loan guarantee, LPO now has $2.5 billion in remaining loan guarantee authority for Innovative Clean Energy projects.

“Accelerating the commercial deployment of clean hydrogen as a zero-emission, long-term energy storage solution is the first step in harnessing its potential to decarbonize our economy, create good-paying clean energy jobs and enable more renewables to be added to the grid,” Energy Secretary Jennifer Granholm said.

Green hydrogen plays an important role in the Biden administration’s goal of reaching net-zero emissions by 2050.

DOE’s National Energy Technology Laboratory determined that U.S. clean hydrogen production and use must increase 50-fold by 2050 to meet the country’s decarbonization goals.

Report findings noted while many opportunities exist for hydrogen’s growth, government leadership would be critical in achieving decarbonization goals. This would include tax credits and incentives, research, development and demonstration funding.

The DOE’s Office of Energy Efficiency and Renewable Energy has announced its intent to issue a funding opportunity to analyze the potential for regional clean energy deployments, all in the name of reducing the cost of green hydrogen production from $5 per kilogram to $1 by 2030.

Additionally, President Biden’s FY 2022 budget request includes $400 million for hydrogen activities, compared to $285 million in FY 2021.

Green (or clean) hydrogen produced using renewable energy and electrolysis represents only 5% of the hydrogen produced in the U.S. due to its high cost. In comparison, the remaining 95% is produced using fossil fuels.

So-called “blue hydrogen” from natural gas incorporates carbon capture and storage. However, recent studies suggest the practice could produce even more carbon emissions in heat generation than natural gas alone.

Read More